Keeping tabs on money is essential in the hectic corporate environment of today. Integrating accounting and fixed asset records is an important breakthrough for any company. All transactions involving fixed assets will be properly recorded and represented in the financial statements thanks to this integration. This guide will explain the advantages, the methods to adopt them, and provide some examples to illustrate how it all works, whether you’re an expert accountant or simply interested in how companies keep their finances organized. Alright, let’s begin!

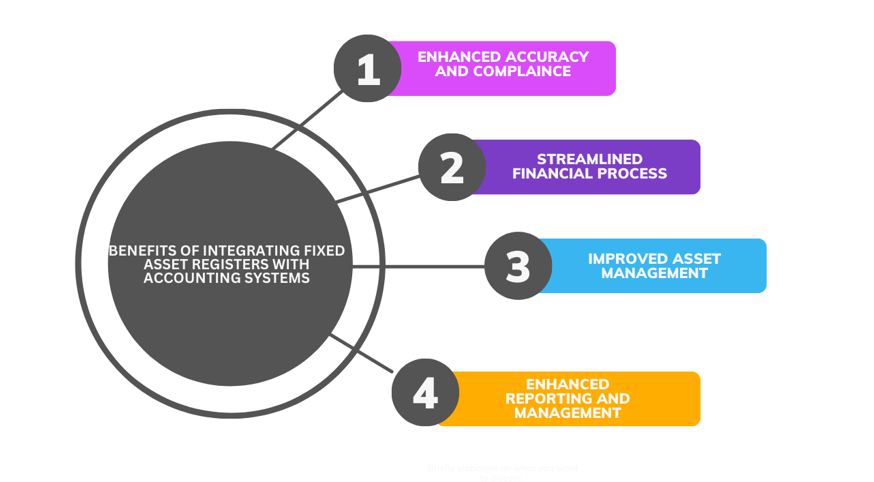

Benefits of Integrating Fixed Asset Registers with Accounting Systems

Enhanced Accuracy and Compliance

Merging fixed asset registers with accounting systems results in the fade-off of human mistakes. Automation brings trust by recording asset values, depreciation, and disposals accurately. This precision helps companies meet the requirements of accounting standards and regulations.

Example: Automated depreciation calculations ensure financial reports reflect accurate asset values without manual input.

Streamlined Financial Process

Integration cuts down redundant data entry and reduces admin workload. This frees up finance teams to focus on strategic tasks instead of manual record-keeping.

Example: A single entry for asset acquisition updates both the fixed asset register and the general ledger, saving time and effort.

Improved Asset Management

Integrated systems offer a complete view of all assets, making tracking and management easier. This aids in making informed decisions about maintenance, replacement, and use.

Example: Real-time tracking of asset locations and conditions helps in timely maintenance and prevents unexpected breakdowns.

Enhanced Reporting and Management

Integration allows for detailed reports and analysis, providing insights into asset performance and financial health. These reports support strategic planning and decision-making.

Example: Detailed depreciation reports help in analyzing the impact of asset wear and tear on overall profitability.

Steps for Integration

1.Assessment and Planning

Start with a thorough assessment of your current systems and processes. Identify what you need and the challenges in your fixed asset management and accounting. Plan the integration process, set objectives, and determine the resources needed.

2.Selecting the Right Software

Choose software that supports seamless integration between fixed asset registers and accounting systems. Look for features like automated data sync, real-time updates, and compatibility with existing systems.

3.Data Migration and System Setup

Move existing data from different systems into the new integrated platform. This step needs careful data mapping to ensure accuracy. Set up the system according to your needs, configuring asset categories, depreciation methods, and reporting formats.

4.Testing and Training

Conduct thorough testing to ensure the integration works smoothly. Fix any issues before going live. Train your finance team to ensure they are comfortable using the new system and understand its functions.

5.Go Live and Monitor

After successful testing, go live with the integrated system. Keep an eye on the performance and gather feedback from users to make necessary adjustments and improvements.

Examples of Successful Integration

Automated Depreciation Calculation

A manufacturing company integrated its fixed asset register with its accounting system, enabling automated depreciation calculations. This eliminated manual errors and ensured accurate financial reporting.

Real-Time Asset Tracking

An IT firm implemented an integrated system to track its numerous IT assets in real-time. This improved asset utilization and streamlined the maintenance schedule, reducing downtime.

Efficient Disposal Management

A retail chain used integrated systems to manage the disposal of outdated assets. The system automatically recorded disposals in the financial statements, ensuring compliance and accurate record-keeping.

Questions to Understand your ability

Ques1: What is a primary benefit of integrating fixed asset registers with accounting systems?

- Increased manual data entry

- Enhanced accuracy and compliance

- Decreased reporting capabilities

- Higher administrative workload

Ques2: Which of the following is a key feature to look for in software for integrating fixed asset registers with accounting systems?

- Manual data synchronization

- Real-time updates

- Complex user interface

- Limited compatibility

Ques3: What is one example of improved asset management through integration?

- Increased human error

- Real-time tracking of asset locations

- Manual depreciation calculation

- Delayed financial reporting

Ques4: What should be done before going live with the integrated system?

- Ignore user feedback

- Skip the testing phase

- Conduct thorough testing and provide training

- Delay data migration

Ques5: Which step involves moving data from existing systems to the new integrated platform?

- Assessment and Planning

- Data Migration and System Setup

- Go Live and Monitor

- Selecting the Right Software

Conclusion

The financial management that could be both effective and accurate would be determined by integration with fixed asset registries. Automation eases operations but, at the same time, enhances accuracy, a shot in the arm for better financial well-being and decision-making. Any company, however big or small, will benefit in the long run. Get your company to long-term success by embracing technology to simplify accounting and asset management.

FAQ’s

For ensuring accuracy in financial records, removing errors and acquiring compliance.

It cuts down on redundancy in data entry, cuts admin work, and let’s finance teams focus on strategy.

Automation in data syncing, regular updates and compatibility with current systems.

We must examine the current systems, understand the requirements and obstacles, and establish objectives that the integration process will accomplish.

It ensures data accuracy and consistency when moving to the new system.

It helps with timely maintenance, prevents breakdowns, and boosts asset management.

It provides detailed reports and insights on asset performance, aiding strategic planning.

Testing of the entire product to be tested, troubleshooting of issues encountered, and guiding the staff in finance on how to use the new system.