Accumulated depreciation is not merely a sophisticated accounting term. It is a critical concept that narrates the process by which assets lose value over time. We will explore the meaning, functionality, and significance of this concept.

What is Accumulated Depreciation?

Accumulated depreciation represents the total decrease in a fixed asset’s value since its acquisition. Think of it like a car’s mileage: the more you use it, the less valuable it becomes. The balance sheet records this value, which lowers the asset’s book value.

Why Do We Depreciate Assets?

Machinery, vehicles, and buildings are not indestructible. They wear out, break down, or become obsolete. Depreciation distributes the cost of these assets over their useful lifetimes. This aligns the revenue generated by the asset with the expense of its use, thereby providing a more accurate measure of profitability.

Example:

Consider purchasing a machine for Rs. 10,000. It is projected to be obsolete in ten years. Rather than recording a Rs. 10,000 expenses in the first year, you allocate Rs. 1,000 per year. You ensure cost matches use duration by doing so.

How is Depreciation Calculated?

Straight-Line Method

This is the simplest method. Each year, you deduct an equal amount.

Declining Balance Method

The method prioritizes the expense by deducting a greater amount in the initial years.

Depreciation Expense = Book Value at Beginning of Year × Depreciation Rate

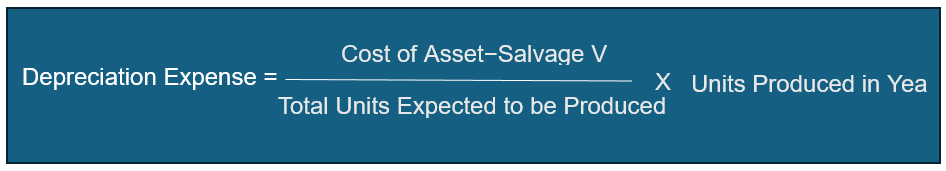

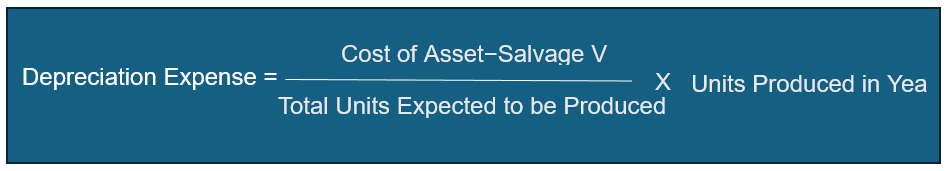

Units of Production Method

This method links depreciation to usage. If you use the asset more in one year, you depreciate it more.

Recording Accumulated Depreciation

The asset section of the balance sheet records accumulated depreciation. It is classified as a contra-asset account, which implies that it diminishes the value of the fixed assets. If a machine’s cost is Rs. 10,000 and its accumulated depreciation is Rs. 4,000, its net book value is Rs. 6,000.

Impact on Financial Statements

Accumulated depreciation affects both the income statement as well as the balance sheet.

- Balance Sheet: Reduces the book value of assets.

- Income Statement: Depreciation expense reduces net income.

Importance of Accumulated Depreciation

Reflects Asset Value

Assets would be recorded at their original cost, which would not accurately represent their true value if depreciation were not implemented.

Affects Profitability

Depreciation spreads out the cost of an asset, allowing for a more accurate annual profit projection.

Helps in Budgeting

Knowing the amount by which an asset depreciates is helpful for planning future purchases.

Accumulated Depreciation in Real Life

In all sectors, businesses implement accumulated depreciation. This practice is prevalent in a variety of industries, including manufacturing companies that depreciate hefty machinery and technology firms that depreciate computers.

Tax Implications

Depreciation is not solely a matter of accounting; it also impacts taxation. Businesses may reduce their taxable income by deducting depreciation expenses. However, specific rules in tax laws frequently regulate the calculation of depreciation.

Example: Accelerated Depreciation

For tax purposes, a business may use an accelerated depreciation method, such as the double-declining balance, to obtain greater deductions in the initial years of operation.

Challenges with Accumulated Depreciation

Estimating Useful Life

It is not always straightforward to ascertain the lifespan of an asset. Inaccurate depreciation calculations may result from misestimating.

Changes in Usage

A substantial change in an asset’s utilization may affect the depreciation method and amount.

Obsolescence

Occasionally, assets become obsolete at a quicker rate than anticipated, necessitating modifications to their useful life and depreciation.

Questions to Test Your Understanding

Ques1: What is accumulated depreciation?

- The total cost of an asset

- The original purchase price of an asset

- The market value of an asset

- The total decrease in the value of an asset since its acquisition

Ques2: Which method of depreciation spreads the cost of an asset evenly over its useful life?

- Declining Balance Method

- Straight-Line Method

- Units of Production Method

- Sum-of-the-Years-Digits Method

Ques3: How is accumulated depreciation recorded on the balance sheet?

- As a liability

- As an asset

- As a contra asset

- As equity

Ques4: What does a higher accumulated depreciation indicate about an asset?

- The asset has been used extensively

- The asset is relatively new

- The asset has appreciated in value

- The asset has a longer useful life remaining

Ques5: Which of the following is NOT an impact of accumulated depreciation?

- Reduces the book value of assets

- Increases net income on the income statement

- Affects taxable income

- Reflects the wear and tear of assets

Summary

Accumulated depreciation does more than merely represent numbers on documents—it plays an essential role in accounting, through which firms can track their assets, prepare for upcoming years, and give an honest portrayal of their finances. It matters to everyone who wants to see how well an organization is doing financially, including students studying finance and those working as professional accountants.

Stay curious, keep learning, and remember depreciation isn’t just about losing value; it’s about spreading costs wisely and reflecting true worth over time.

FAQ's

The total depreciation expenses recorded against a fixed asset since its acquisition constitute accumulated depreciation. It is important because it represents the asset’s diminishing value over time due to obsolescence, wear and tear, and use.

Depreciation expense is the amount of depreciation recorded for a specific accounting period, whereas accumulated depreciation is the aggregate of depreciation recorded over the asset’s entire life.

No, the accumulated depreciation cannot exceed the asset’s cost. Upon completion of the depreciation process, the asset’s book value will be decreased to its salvage value, which is zero

The total accumulated depreciation of an asset is determined by adding up all of the periodic depreciation expenses that have been recorded since its acquisition.

When an asset is sold or disposed of, the accumulated depreciation is removed from the books along with the original cost of the asset. The difference between the asset’s net book value and the sale price or disposal value is recorded as a gain or loss.

The fixed asset’s cost is offset by the accumulated depreciation, which is depicted as a contra asset. It offers a net book value that more precisely represents the asset’s current value.

On the balance sheet, accumulated depreciation reduces the book value of fixed assets. On the income statement, annual depreciation expense decreases net income.

The common methods are the straight-line method, the declining balance method, as well as the units of production method. Each method allocates an asset’s cost differently over its useful life.