Tax Implications of Depreciation

Both accounting and taxation use depreciation to show how asset values decline over time. Depreciation has a significant impact on taxation, altering businesses’ tax burden as well as their financial planning and reporting practices. This blog goes into detail about how depreciation affects taxes, looking at the law, different ways, and real-life examples.

Understanding Depreciation and Its Importance

Depreciation involves spreading out the costs of a tangible asset over its useful lifespan in a structured manner. It enables businesses to assess the cost of utilizing an asset in relation to the revenue it generates. This accounting method not only enhances the accuracy of financial assessments but also carries significant tax advantages.

Why Depreciation Matters in Taxation

From a taxation standpoint, depreciation serves to lower taxable income and acts as a protective measure against taxes. It permits businesses to subtract depreciation costs, encouraging investment in assets that enhance productivity. The Income Tax Act of 1961 emphasizes the importance of depreciation in tax planning for businesses.

Statutory Provisions under the Income Tax Act, 1961

Section 32: Depreciation Allowance

Section 32 of the Income Tax Act, 1961, regulates the provision for depreciation, allowing for the depreciation of tangible and intangible assets utilized for business or professional activities.

This section outlines the assets eligible for depreciation claims, which include:

- Buildings

- Machinery

- Plant

- Furniture

- Intangible assets such as patents and trademarks

Depreciation Rates

The Income Tax Rules, 1962, explain the depreciation rates, which fluctuate based on the type of asset and its utilization. Here are several prevalent rates:

- Residential Buildings: 5%

- Non-residential Buildings: 10%

- Plant and Machinery (general): 15%

- Plant and Machinery (continuous process): 30%

- Computers and related peripherals: 40%

- Motor Vehicles: 15%

Additional Depreciation

To encourage investment in new machinery, the Income Tax Act offers an additional depreciation of 20% for new plants and machinery acquired by manufacturing entities.

Example: If a manufacturing company purchases new machinery for ₹20,00,000, it can claim an additional depreciation of ₹4,00,000 (20% of ₹20,00,000) in the year of purchase.

Conditions for Claiming Depreciation

The following requirements must be satisfied in order to claim depreciation under the Income Tax Act:

- The assessee must own the asset, either fully or partially.

- The assessee’s business or profession must use the asset.

- Even if the asset is used for part of the year, depreciation is acceptable.

Methods of Depreciation

Written Down Value (WDV) Method

The Income Tax Act primarily employs the Written Down Value (WDV) method for depreciation calculation. This approach entails applying a fixed percentage of depreciation to the remaining balance of the asset each year.

Formula: Depreciation Expense = Book Value × Depreciation Rate

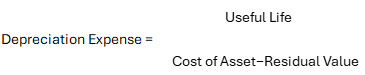

Straight-Line Method (SLM)

Although less prevalent for tax calculations, the Straight-Line Method (SLM) distributes depreciation evenly across each year of the asset’s useful lifespan, ensuring a consistent depreciation amount annually.

Formula:

Impact on Taxable Income

Depreciation reduces businesses’ taxable income, thereby lowering their tax liability.

Example: A company buys a machine for ₹10,00,000 with a useful life of 10 years and a residual value of ₹1,00,000. Using the Written Down Value (WDV) method at a 15% depreciation rate, the first year’s depreciation is ₹1,50,000. With a profit of ₹20,00,000 before depreciation, the taxable income is reduced to ₹18,50,000 after accounting for depreciation. This reduction in taxable income shows how depreciation helps lower the company’s tax liability.

Practical Considerations

Documentation

Thorough documentation and regular maintenance of asset registers are important. Tax assessments may disqualify depreciation claims due to insufficient records.

Asset Classification

Accurate asset classification is critical, as varying assets are subject to different depreciation rates. Misclassification can lead to incorrect depreciation claims and potential penalties.

Compliance with Accounting Standards

Tax depreciation adheres to the guidelines outlined in the Income Tax Act, whereas accounting depreciation must adhere to the Indian Accounting Standards (Ind AS). To maintain compliance, businesses must ensure accurate calculations and reporting of both types.

Depreciation on Revaluation

If an asset undergoes revaluation, accounting should calculate depreciation based on the revalued amount. However, for tax purposes, depreciation is only permissible at the original cost of the asset.

Questions to Test Your Understanding

- Which section of the Income Tax Act, 1961 regulates the provision for depreciation?

- Section 30

- Section 32

- Section 35

- Section 37

- What is the depreciation rate for plants and machinery under the Income Tax Rules, 1962?

- 5%

- 10%

- 15%

- 20%

- Which method of depreciation is primarily employed by the Income Tax Act?

- Straight-Line Method

- Units of Production Method

- Written Down Value Method

- Sum of Years Digits Method

- What is the additional depreciation rate for new plants and machinery acquired by manufacturing entities?

- 10%

- 15%

- 20%

- 25%

- Which of the following is NOT a condition for claiming depreciation under the Income Tax Act?

- The asset must be owned fully or partially by the assessee.

- The asset must be used for personal purposes.

- The assets must be used for business or professional activities.

- Depreciation is allowable even if the asset is used for part of the year.

Summary

Depreciation plays an important role in tax planning strategies for Indian businesses. It serves as a mechanism to gradually recover asset costs, thereby lowering taxable income and facilitating effective cash flow management. Thorough comprehension of statutory regulations, precise depreciation calculations, and meticulous documentation maintenance are imperative for maximizing its advantages. Through these practices, businesses can optimize their tax obligations and bolster their financial efficacy. Remaining up to date on changes in depreciation regulations and rates is critical for adept tax planning, and seeking professional guidance can help streamline the process during its difficulties.

FAQ's

Depreciation is the systematic allocation of a tangible asset’s costs over its useful life. It reflects the decline in the asset’s value due to usage, wear and tear, or obsolescence.

Depreciation lowers taxable income by allowing businesses to deduct the expense of using an asset over time, thereby reducing their tax liability.

The two common methods are the Written Down Value (WDV) method and the Straight-Line Method (SLM).

The WDV method applies a fixed percentage of depreciation to the asset’s book value each year, which causes the depreciation expense to decrease over time.

Manufacturing entities can claim additional depreciation as an extra deduction for new plants and machinery, which encourages investment in productive assets.

The assessee must own the asset and use it for business or professional activities; depreciation is allowed even if the asset is used for part of the year.

Accurate classification is crucial because different types of assets have different depreciation rates. Misclassification can lead to incorrect claims and potential penalties.

Depreciation reduces the taxable income by deducting the expense of the asset’s usage, thereby lowering the overall tax liability of the business.