In contrast to time-based calculations, often included in other traditional approaches, the depreciation method, which considers the extent of use of an asset, is based on units of production. This approach is particularly beneficial for manufacturing facilities as well as their related equipment.

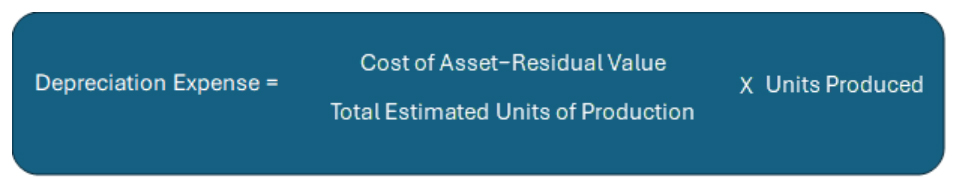

Formula of Production Unit Method

The Production Unit Method distributes an asset’s cost based on its utilization or output. The formula for calculating depreciation using the Production Unit Method is as follows:

Where:

- Depreciation Expense is the amount of depreciation expense for the period.

- The asset’s cost is the original cost of the asset.

- Residual Value (or Salvage Value) is the estimated value of the asset at the end of its useful life.

- Total Estimated Units of Production is the total expected units the asset will produce over its useful life.

- Units Produced is the actual number of units produced during the accounting period.

When Should Units of Production be Utilized?

Not all businesses find the units of production method suitable for depreciating assets. It’s most applicable to companies possessing machinery or equipment involved in manufacturing processes, where each unit produced contributes to asset wear and tear.

Moreover, this approach demands more complicated calculations and estimations compared to other depreciation methods. Companies employing this method must compute depreciation expenses annually, as they fluctuate based on production levels. Unlike time-based depreciation methods that allow for automated entries, predicting future production levels isn’t feasible, necessitating ongoing assessments. Additionally, this method isn’t recognized for tax purposes, necessitating a conversion to align depreciation expenses for tax reporting.

Although implementing this method requires additional effort, it offers a precise representation of asset usage costs for businesses with production equipment. For management, this accuracy proves invaluable in budgeting and assessing the profitability of sold items.

Advantages of Production Unit Method

Let’s explore the advantages of utilizing the unit of production depreciation method through the following points:

Accurate Charging Process: Only charges for actual usage. No more, no less.

Efficiency Assessment: Links depreciation to output, helping you gauge efficiency.

Matching Costs with Revenue: Aligns depreciation with revenue from production.

Precise Profit and Loss Tracking: More accurate than the straight-line method.

Offsetting Higher Production Costs: High production means high depreciation, which balances out those costs.

Suitability for Manufacturing: Bases charges on units produced, not time, for precise cost allocation.

Disadvantages of Production Unit Method

But watch out for these drawbacks:

Limited Depreciation Factors: Only considers usage, not other depreciation factors like time.

Idle Assets: Can’t charge depreciation when assets are idle, which skews value.

Complexity in Calculation: Tracking multiple assets with varying outputs is a hassle.

Discrepancies in Asset Valuation: Similar assets might have different depreciation due to usage differences.

Ineligibility for Tax Purposes: Not accepted for tax reporting.

Limited Applicability: Only good for manufacturing assets, not buildings or furniture.

Neglect of Time-based Depreciation: Ignores time-based wear and tear.

Infeasibility for Certain Businesses: Not practical for trading companies or service industries.

Questions to Understand your ability

Ques1: What does the production unit method of depreciation focus on?

- Time-based calculations

- Asset’s purchase cost

- Amount of use or production of the asset

- Residual value only

Ques2: Which industries get the most out of the production unit method?

- Retail

- Manufacturing

- Real estate

- Service industries

Ques3: What’s a big advantage of the production unit method?

- Simple calculations

- Automated depreciation entries

- Accurate charging based on asset usage

- Consistent depreciation no matter the use

Ques4: Why is the production unit method tough to use?

- Needs constant tracking of asset production

- Ignores the cost of the asset

- Doesn’t account for asset efficiency

- Neglects the residual value of the asset

Ques5: Which is a drawback of the production unit method?

- Only good for manufacturing assets

- Matches costs with revenue

- Considers time-based depreciation

- Easy to calculate

Summary

- The system calculates depreciation based on an asset’s utilization or output.

- It is advantageous for manufacturing industries with fluctuating production levels.

- The formula considers the asset’s cost, residual value, total estimated production units, and units produced.

- Implementation requires precise tracking of assets and production levels.

- Advantages: accurate charging processes, efficiency assessment, and precise profit and loss tracking.

- The disadvantages include limited depreciation factors, complexity in calculation, discrepancies in asset valuation, ineligibility for tax purposes, and limited applicability to certain businesses.

FAQ's

It’s a way to calculate depreciation based on how much an asset is used. Perfect for manufacturing where equipment wears and tear ties directly to production.

It matches depreciation costs with actual asset use, making financial reports more precise for companies with varying production levels.

By showing higher depreciation during high productivity periods, companies can get bigger tax deductions, offsetting higher costs.

Manufacturing industries, where equipment usage varies and affects asset wear and tear, get the most benefit.

The method looks at how much the asset cost, how much it is still worth, how many units were expected to be made, and how many units were actually made during the time.

It’s complex, needs meticulous tracking of each asset’s production output, and isn’t suitable for all asset types or industries.

No, tax rules usually require depreciation based on set methods, not production units, so this method isn’t used for tax reports.

It’s not practical for businesses without production equipment, like trading companies and service industries, where depreciation isn’t tied to production output.