Properly understanding the components of working capital plays a huge part when we talk about handling business properly. The smooth running of daily operations and facing sudden unforeseen financial requirements can be met with the help of sufficient working capital. This all states that knowing about components of the working capital is very essential, as are the interactions with current assets and current liabilities. These interactions aid in measuring the availability of the funds to complete the operations without much problem.

What is working capital?

Working capital can be measured by finding the difference between all the current assets that the business acquired and the current liabilities of the business. Both are components of working capital as well.

Due to normal business activities, the company’s assets that are expected to be sold or used in the upcoming year are known as current assets. On the other hand, any company’s short-term financial obligations that are required to be paid in the span of a year or under the regular operational flow are known as current liabilities.

To measure working capital appropriately, the given formula can be used:

Working Capital = Current Assets – Current Liabilities

What are the components of working capital?

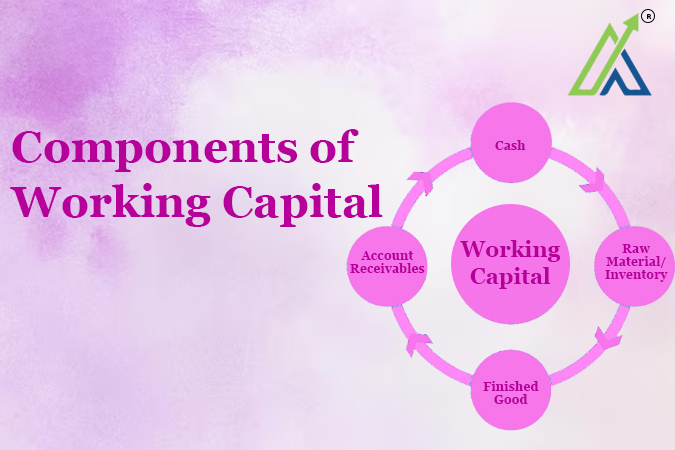

The below four components are the important ones when we talk about components of working capital:

Trade receivables

Trade receivables are one of the integral parts of the current assets. It is also known as account receivables or bills receivables. It is the payments that the company owes the customers in the everyday business activities.

Cash and cash equivalent

Cash is the prominent requirement of any business. Cash cannot only be described as currency notes or bank balances, as it includes the assets that can be easily transformed into cash according to the need of the time. Result-oriented cash management shows that the company consistently has sufficient funds to meet the sudden and regular financial requirements.

Inventory

Inventory is also considered one of the components of working capital. The measurement of raw materials and end products that the company possesses is known as inventory. Maintaining a balance between the inventory stock, consumption, and requirement. Excess stock leads to an increase the warehousing cost; however, a shortage will result in the freeze of operations and the availability of finished goods.

Trade payables

The money a company owes its suppliers is known as trade payables. In the books of accounts, their credit purchases for supplies and raw materials are recorded as trade payables. It comprises the promissory notes and bills of exchange that a company must pay.

Drawbacks of working capital

Understanding the limitations is also important for any business. Preserving the financial stability and the business’s liquidity are aided by the working capital, but there are some limitations of working capital also, which are given below: –

- It is an endlessly shifting factor and can be changed from day to day. Working capital changes are based on the liabilities settled and the assets that are obtained. This all results in the lack of consistency because it changes from the start of the month till its end. Also, it is not possible to measure it on a day basis.

- While computing the working capital, only the components related to it are considered, and other factors are not considered that impact the company. Other factors can be economic downturn, rising price, subsidiaries, etc. These things can affect the sufficiency of the capital, which is overlooked here.

- Additionally, it disregards any abrupt asset depreciation. One of your trade payables, for instance, may become a bad debt. Inventory is vulnerable to theft and damage. Despite having an impact on working capital availability, these factors are not taken into account.

Questions to Understand your ability

Q1.) How do you calculate working capital?

a) Working Capital = Current Assets + Current Liabilities

b) Working Capital = Current Assets – Current Liabilities

c) Working Capital = Trade Receivables – Trade Payables

d) Working Capital = Cash + Inventory – Trade Payables

Q2.) Which of these isn’t a part of working capital?

a) Trade Receivables

b) Cash and Cash Equivalents

c) Inventory

d) Fixed Assets

Q3.) What’s the biggest danger with holding too much inventory?

a) Reduced cash flow

b) Increased warehousing costs

c) Increased trade payables

d) Lower trade receivables

Q4.) What’s a major limitation of working capital?

a) It’s impossible to calculate precisely

b) It’s always changing, day-to-day

c) It always gives a clear picture of the business’s health

d) It includes long-term debts

Q5.) Which of these is an example of trade payables?

a) Payments owed to customers for products sold

b) Money owed to suppliers for raw materials

c) Cash reserves

d) Bills for office rent

Conclusion

In conclusion, working capital is essential for the smooth running of a business, helping it meet daily expenses and unexpected financial needs. However, it has limitations, as it can fluctuate daily and doesn’t account for external factors like economic changes or asset depreciation. While managing working capital is important, businesses must also be aware of these factors to maintain financial stability and avoid operational disruptions.

FAQ's

It’s the difference between what you own short-term (current assets) and what you owe short-term (current liabilities). In simple terms: Can you pay your bills today with what you have in hand? That’s your working capital.

Working Capital = Current Assets – Current Liabilities

Subtract what you owe from what you own, you’ve got your working capital.

These are the things you plan to turn into cash or use up in the next year — cash in hand, trade receivables (money owed to you), and inventory (goods in stock). Basically, anything that can be sold or consumed soon.

Short-term debts. These are the bills you need to pay within a year — like money you owe to suppliers (trade payables) or short-term loans. If you owe it in the next 12 months, it’s a current liability.

Trade receivables are just your clients’ unpaid bills. It’s the money they owe you for goods or services you’ve already delivered. They might pay soon, or maybe never.

Inventory’s a double-edged sword. Too much stock? Your cash is tied up, and storage costs rise. Too little? You can’t meet demand, and your operations grind to a halt. Balance is key.

These are the bills you owe your suppliers. When you buy stuff on credit (materials, supplies), those bills get recorded as trade payables. It’s the opposite of trade receivables — you’re the one who’s paying.

It’s never constant. Working capital changes daily based on what’s bought or sold. Plus, it ignores things like market shifts, rising costs, or asset depreciation. If your receivables turn bad, or inventory gets stolen, that’s not reflected here.