Accounting relies heavily on depreciation as it allows companies to amortize the cost of tangible assets over their useful life. Picking the correct depreciation method can have a big effect on a company’s financial statements, tax liabilities, and general financial health. This guide will provide all the necessary information to select the optimal depreciation method, considering factors such as the asset’s type, its intended use, and industry standards.

Understanding Depreciation

Depreciation is the process of a fixed asset’s recorded cost going down over time. Depreciation considers wear and tear, breaking down, and becoming useless over time. When companies in India figure out depreciation, they follow the rules set out in the Companies Act, 2013 and the Income Tax Act, 1961. Both statutes have different rates and methods, so companies must pick the one that works best for their financial strategies and meets all the requirements.

Common Depreciation Methods

1. Straight Line Method (SLM)

The Straight-Line Method distributes an asset’s cost evenly over its useful life.

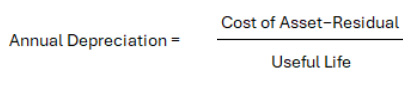

Formula:

Example: Consider a machinery purchased for ₹1,00,000 with a useful life of 10 years and a residual value of ₹10,000. The annual depreciation would be ₹9,000.

Suitable For: Buildings and office furniture are examples of assets with a consistent usage pattern.

Industry Norms: Industries like real estate and hospitality, where asset utility is stable over time, frequently use SLM.

2. Written Down Value Method (WDV)

The Written Down Value Method assigns a fixed percentage rate of depreciation to the asset’s declining book value.

Formula: Depreciation = Book Value at Beginning of Year × Rate of Depreciation

Example: A vehicle purchased for ₹5,00,000 with a depreciation rate of 20% would have a depreciation of ₹1,00,000 in the first year and ₹80,000 in the second year.

Suitable For: Things like vehicles and machinery that lose value quickly or cost more to maintain in the first few years.

Industry Norms: Industries like transportation and heavy machinery, where assets depreciate quickly, prefer WDV.

3. Units of Production Method

This method depreciates on the basis of actual usage, activity, or units produced.

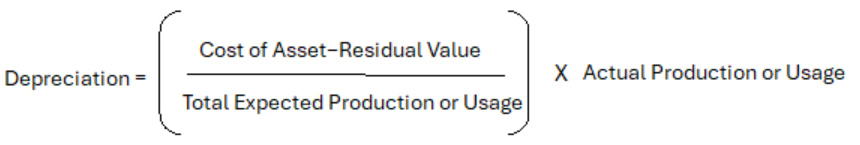

Formula:

Example: For a machine costing ₹2,00,000 with an expected production capacity of 1,00,000 units and a residual value of ₹20,000, the depreciation per unit is ₹1.80. If 10,000 units are produced in a year, the depreciation would be ₹18,000.

Suitable For: Manufacturing equipment is one of the assets whose usage significantly varies from year to year.

Industry Norms: Production volume directly influences asset wear and tear in manufacturing industries.

4. Sum of the Years’ Digits Method

With this accelerated depreciation method, an asset’s depreciation expense is higher in its first few years of use.

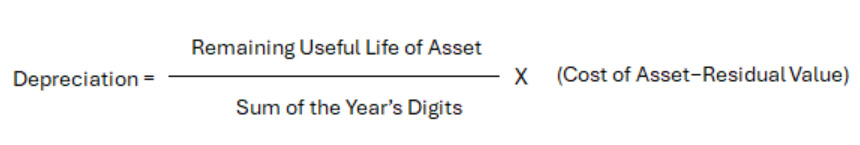

Formula:

Example: For an asset costing ₹1,50,000 with a useful life of 5 years and a residual value of ₹10,000, the sum of the years’ digits is 15 (5+4+3+2+1). In the first year, the depreciation would be 5/15 × (1,50,000−10,000) =₹46,667.

Suitable For: Assets that bring in more money in the first few years.

Industry Norms: Technological advancements quickly render assets obsolete in industries like electronics and IT.

Factors Influencing the Choice of Depreciation Method

Asset Type and Nature

The asset’s nature has a significant impact on the depreciation method chosen. For example:

- Buildings and Real Estate: The consistent utility of SLM makes it preferred.

- Machinery and Vehicles: The preference for WDV (Written Down Value) or Units of Production depreciation methods often stems from the accelerated depreciation experienced in the initial years and the wear and tear based on usage.

Expected Usage Pattern

- Consistent Usage: SLM works best when used consistently over time.

- Variable Usage: Manufacturing equipment can use the Units of Production method because it matches depreciation to real use.

Industry Norms and Practices

Depending on the nature of their assets, different industries have standard practices:

- IT and Electronics: In IT and Electronics, accelerated methods such as WDV and Sum of the Years’ Digits are often used due to rapid obsolescence.

- Transportation: The preference for WDV is due to its high initial depreciation.

Financial and Tax Implications

- Tax Benefits: Businesses may opt for the Written Down Value (WDV) method to leverage tax advantages, as it yields higher depreciation deductions in the early years, thus lowering taxable income.

- Financial Reporting: The Straight-Line Method (SLM) offers a smoother expense recognition pattern, enhancing the predictability of financial statements.

Regulatory Compliance

The Companies Act, 2013 and the Income Tax Act, 1961 are laws that businesses must follow. There are different needs for each:

- Companies Act: The Companies Act prescribes useful lives for a variety of assets and generally permits SLM and WDV.

- The Income Tax Act: It provides specific depreciation rates and typically follows WDV.

Questions to Test Your Understanding

Q 1. Which depreciation method spreads the cost of an asset evenly over its useful life?

- Written Down Value Method (WDV)

- Straight Line Method (SLM)

- Units of Production Method

- Sum of the Years’ Digits Method

Q 2: The Written Down Value Method (WDV) is most suitable for which type of assets?

- Assets with consistent usage patterns

- Assets that provide greater economic benefits in the initial years

- Assets that lose value quickly or have higher maintenance costs in the initial years

- Assets with variable usage

Q 3: Which method of depreciation bases the expense on actual usage or units produced?

- Straight Line Method (SLM)

- Written Down Value Method (WDV)

- Units of Production Method

- Sum of the Years’ Digits Method

Q 4: In the Sum of the Years’ Digits Method, how is the depreciation calculated?

- By spreading the cost evenly over the useful life

- By applying a fixed percentage rate to the diminishing book value

- By allocating a higher depreciation expense in the earlier years of the asset’s life

- By basing depreciation on actual usage or units produced

Q 5: According to Indian regulatory compliance, which Acts must businesses adhere to for depreciation?

- The Companies Act, 2013, and the Income Tax Act, 1961

- The Indian Penal Code, 1860, and the Companies Act, 2013

- The Income Tax Act, 1961, and the GST Act, 2017

- The Companies Act, 1956, and the Income Tax Act, 1961

Summary

Choosing the correct depreciation method is a strategic choice that affects how you report your finances, how much tax you owe, and the general health of your business. Companies in India must consider the type of asset, its intended use, industry standards, financial impacts, and government regulations when selecting a depreciation method. Companies can get the correct financial information and the best tax benefits by making sure that the depreciation method takes these things into account.

Whichever method you choose—the Straight-Line Method, the Written Down Value Method, the Units of Production Method, or the Sum of the Years’ Digits Method—it’s crucial to understand their differences and how to apply them to your situation.