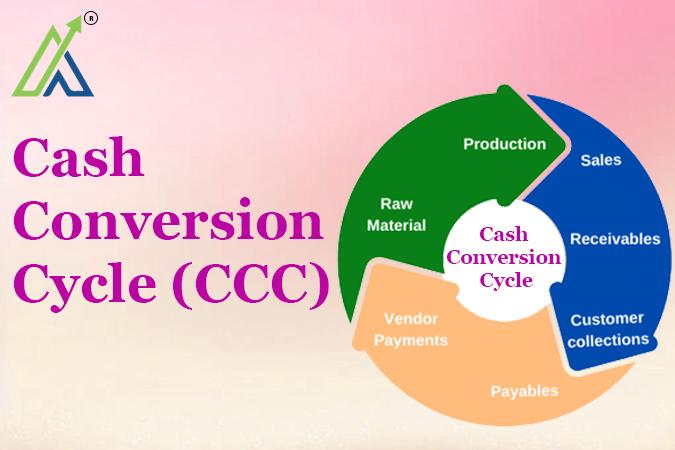

The Cash Conversion Cycle (CCC) is a crucial measure of how fast a business can turn its investments in inventory and receivables into cash. It tells you how quickly your business can move from spending money on raw materials to collecting payments from customers. Think of it as a race: the faster you can convert your investments into cash, the more efficient and profitable your business becomes.

If your cycle’s short, you’re in the green. A long cycle? Well, you’re just holding on to cash that’s stuck in the system, and that’s never good for business.

What’s the Cash Conversion Cycle?

The Cash Conversion Cycle tracks how long it takes for a business to turn inventory into cash. The faster this happens, the better. It’s all about speed. The formula is simple:

CCC = Inventory Days + Receivables Days – Payables Days

This means:

Inventory Days: How long does it take to sell your products after you buy them?

Receivables Days: How long until your customers pay you after you’ve made a sale?

Payables Days: How long do you take to pay your suppliers for the goods or services you’ve bought?

Why the Cash Conversion Cycle Matters?

The Cash Conversion Cycle functions as your company’s lifeblood. It tells you how efficiently you’re managing your working capital. A short CCC means you’re quickly turning investments into cash, while a long CCC means cash is stuck somewhere in the process.

Here’s why the CCC is key:

Cash Flow: A shorter CCC means better cash flow. More cash in hand is equal to less risk and more opportunities.

Working Capital: A shorter CCC reduces the money tied up in inventory and receivables. This means you need less capital to run the business.

Profitability: A shorter cycle means you can sell more, get paid faster, and hold off on paying your suppliers longer, which means more profit. A long CCC eats into your bottom line.

Flexibility: When you convert cash quickly, you’re more flexible in responding to opportunities or challenges. A long cycle, on the other hand, puts you at risk of cash crunches.

Breaking Down the Components

Now, let’s get into the nitty-gritty. To optimize your Cash Conversion Cycle, you need to understand the three core components: Inventory Days, Receivables Days, and Payables Days.

Inventory Days: How Fast Can You Sell?

This measures how long your stock sits before it’s sold. The quicker your inventory moves, the faster you get cash. Simple.

Example: A clothing retailer buys jeans at wholesale prices. If they take a month to sell them, that’s a long time to have money tied up in unsold stock. The quicker they sell, the quicker they get cash to reinvest. You don’t want inventory gathering dust on your shelves.

Receivables Days: How Fast Can You Collect?

Once you sell, how quickly do you get paid? This is where things can get tricky. If you’re waiting 30, 60, or 90 days for customers to pay, you’re losing out on cash. The longer this period, the longer your cycle.

Example: A subscription-based software company sells software packages to clients, but they offer 60-day payment terms. The longer those clients take to pay, the longer the company’s cash is tied up in unpaid invoices. If the company speeds up its receivables collection, they free up cash faster.

Payables Days: How Long Do You Hold Off on Paying?

This is the flip side. Payables Days measures how long you take to pay your suppliers. The longer you can stretch this period without affecting your supplier relationships, the more cash you keep. But you have to find a balance—wait too long, and you risk damaging your reputation.

Example: A furniture manufacturer buys materials on credit and has 90 days to pay. If they stretch those 90 days without missing payments, they can sell the furniture before they pay for the raw materials, keeping cash flow high. But don’t push suppliers too far—too much delay could harm your supplier network.

The Importance of the Cash Conversion Cycle

So why should you care about this? Here’s the deal:

Liquidity: A short CCC means you’ve got cash available to reinvest, pay bills, or take on new opportunities without needing external funding. A long CCC? Well, it ties up your cash, leaving you stuck.

Working Capital Efficiency: The more efficiently you manage your cycle, the less working capital you need. And that means you won’t need to borrow or rely on long-term debt as much. Keep your business lean and efficient.

Profitability: Faster sales, faster collections, and slower payables mean more profit. A longer CCC puts a dent in your margins because of the excessive time your money sits idle in the system.

How to Improve the Cash Conversion Cycle

Want a faster cycle? Here’s how to improve it:

Speed Up Inventory Turnover

Stop sitting on excess stock. The quickly you sell the quickly you get paid. Reduce inventory levels by using tools like just-in-time inventory management or demand forecasting. Sell what you’ve got, don’t let it gather dust.

Example: A bookstore shouldn’t buy more copies of a title than it can sell. Use past sales data to predict demand and avoid stocking too much.

Collect Payments Faster

Don’t wait around for customers to pay. Speed up collections by offering early payment discounts or tightening your credit policies. You can also set up automated reminders and follow-up systems to ensure customers pay on time.

Example: An online retailer could offer a 10% discount for customers who pay within 7 days. This boosts cash flow and reduces receivables days.

Negotiate Better Payment Terms with Suppliers

If you can delay payments to suppliers, do it. Longer payment terms give you more time to sell your products and collect cash before you need to pay for inventory. But don’t push your suppliers too far—maintain healthy relationships.

Example: A wholesaler might negotiate 60-day payment terms with suppliers instead of the usual 30 days. This gives them more time to sell their inventory before paying.

Monitor Your Cash Flow Religiously

Always track your cash flow and evaluate your cash conversion cycle regularly. If you notice your cycle getting longer, it’s time to make adjustments.

Example: A café owner could track their daily sales, inventory levels, and supplier payment deadlines to ensure they’re operating with the shortest cycle possible. This helps prevent cash crunches.

Questions to Understand your ability

Q1.) From the following, which one is used to measure Cash Conversion Cycle (CCC)?

a) How quickly a company makes money from its sales.

b) The time it takes to turn inventory and receivables into actual cash.

c) The speed at which a company pays off its debts.

d) How many suppliers a business has.

Q2.) Which one of these doesn’t belong in the Cash Conversion Cycle (CCC)?

a) Days inventory outstanding (DIO)

b) Days sales outstanding (DSO)

c) Days payables outstanding (DPO)

d) Days of profit margin (DPM)

Q3.) A business with a super-fast Cash Conversion Cycle (CCC) is likely to:

a) Be struggling to pay off debt.

b) Have tons of cash on hand to reinvest into the business.

c) Be stuck with unsold inventory and unpaid bills.

d) Take forever to collect customer payments.

Q4.) How can a company shrink its Cash Conversion Cycle (CCC) without causing chaos?

a) Buy a ton of inventory with no forecast of demand.

b) Force suppliers to wait longer for payment.

c) Speed up how fast you sell your inventory and collect payments.

d) Give customers even longer to pay their bills.

Q5.) Which of these moves would help chop down the Cash Conversion Cycle (CCC)?

a) Stretching out payments to suppliers even more.

b) Getting cash in faster by chasing down customer payments quicker.

c) Handing out more credit to customers without limits.

d) Holding on to inventory until you’re sure it will sell.

Conclusion

The Cash Conversion Cycle is a key indicator of how well a business manages its working capital. A shorter CCC means faster cash flow, higher profitability, and better liquidity. On the other hand, a long cycle can tie up valuable resources and increase financial risk.

Focus on speeding up your inventory turnover, collecting payments faster, and delaying supplier payments where possible. Keep your cash flow in check, and you’ll have the flexibility and funds to invest in growth, tackle opportunities, and avoid the cash flow headaches that plague many businesses.

FAQ's

The CCC tells you how long it takes for a business to turn inventory into cash. The faster, the better. It’s like tracking how quickly you can sell your stuff and get paid.

It’s simple: CCC = Inventory Days + Receivables Days – Payables Days. Basically, it’s the time it takes to sell, get paid, and how long you hold off on paying suppliers.

CCC is everything. It affects working capital, cash flow, and profitability. A shorter CCC means more cash, fewer loans, and better flexibility. A longer one? You’re stuck with cash tied up in inventory and receivables.

The quicker you sell, the quicker you get cash. If your stock’s just sitting there, your cycle drags, and you’re losing out on cash you could be reinvesting.

Longer waits for customer payments = slower cash flow. Speed up collections, and you free up cash quicker. Simple as that.

The longer you can stretch your payments to suppliers, the more cash you hold onto. But don’t push them too far or you risk spoiling relationships.

Sell faster, collect payments faster, and stretch supplier payments. Track everything and modify when needed. If your cycle’s dragging, fix it.

If your cycle’s long, your cash is tied up in stuff that isn’t helping you grow. It means cash flow problems, less flexibility, and lower profits. That’s the risk.