Understanding the Working of the Sinking Fund Depreciation Method

- Determine Depreciation: Determine the total depreciation throughout the asset’s useful lifespan. Typically, this entails subtracting the salvage value from the initial cost of the asset.

- Calculate Annual Contribution: Calculate the yearly investment required for the sinking fund, which hinges on both the anticipated rate of return on investments within the fund and the duration of the asset’s useful lifespan.

- Depreciation Expense: The sinking fund records the cost of depreciation as the first payment each year.

- Accumulate with Interest: Over time, the sinking fund will grow due to both the annual contributions and the compound interest accrued.

- Replace the Asset: At the end of the asset’s useful life, the sinking fund’s total amount, plus interest, should be enough to buy a new asset to replace the old one.

Formula of Sinking Fund

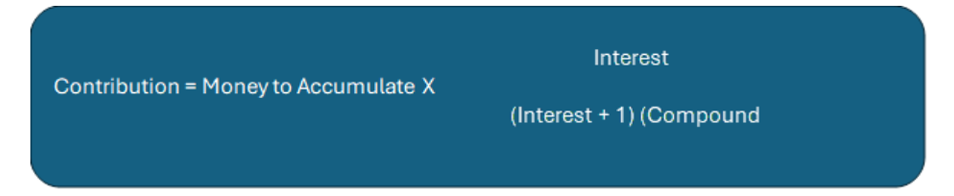

The formula for calculating the periodic contribution for the sinking fund is as follows: Where:

Where:

- The term “money to accumulate” refers to the lump sum amount required upon maturity.

- Interest is the company’s annual compound interest rate on the collected money.

- Compound frequency is the number of times interest is paid in each period.

- The term “period” denotes the duration of the contribution.

Advantages of Sinking Fund Method

- Higher returns: Businesses have the potential to achieve higher returns by investing funds in a sinking fund, utilizing low-risk assets that earn interest, rather than solely expensing the upfront cost of the asset.

- Lower risk: By allocating funds to a sinking fund, businesses can ensure they have enough resources to replace the asset at the end of its useful lifespan, thereby mitigating the risk of unforeseen expenses or disruptions to their operations.

- Improved asset management: Depreciation through a sinking fund incentivizes businesses to maintain their assets more effectively, as they recognize their responsibility for replacing them at the end of their useful lives. This inclination can result in improved maintenance practices and extended asset lifetimes.

- Better cash flow management: Sinking fund depreciation enables businesses to distribute the expense of an asset across its useful life, enhancing their cash flow management. Rather than expensing the full cost of the asset immediately, businesses can allocate a consistent amount annually, facilitating better budgeting and cash flow planning.

Disadvantages of Sinking Fund Method

- Incorrect Selling Price: Listing the assets at their original value presents challenges in determining their selling price.

- Cash Outflow: The business diverts funds, limiting their availability for other purposes.

- Market Volatility: Fluctuations in the stock market can affect investments, introducing ongoing risk to the purchased securities.

- Complex Procedure: This depreciation technique entails intricate calculations, adding complexity to the process.

- Impact on Profit and Loss Account: Setting a fixed depreciation amount and investing it externally may lead to increased repair expenses as the asset ages, affecting the profit and loss account.

Questions to Understand your ability

Ques1: What’s the main goal of the Sinking Fund Method of Depreciation?- Boost asset market value

- Save up money to replace the asset

- Cut down on taxes

- Predict future asset value

- Lowers depreciation expense

- Invests yearly to build enough for asset replacement

- Extends asset lifespan

- Ends future investment needs

- Asset cost, residual value, annual usage

- Lump sum needed, annual interest rate, compound frequency, contribution period

- Asset lifespan, repair costs, tax rate

- Market value, depreciation rate, salvage value

- High initial cash outflow

- Better asset management through regular maintenance

- Easy calculation

- Guaranteed high returns

- Raises asset value

- Market volatility impacting investments

- Easy cash flow management

- High investment returns

Summary

A smart financial way of managing with losses over time of using an asset include determining how to depreciate the asset, estimating annual additions, monitoring on costs, accumulating money with interest and lastly these assets is replaced. This factor considers the sum which is required as a lump sum, rate of interest per complement, period of compounding interest, and period of contribution. This method has its perks: better return, lower amount of risk and probability of loss, efficient management of assets and utilization of liquidity. However, it is not all rosy all the time. Forecasting of asset selling prices might prove to be complex, funds may be diverted, markets might fluctuate, calculations might not be accurate and it impacts the profit and loss remark.FAQ's

It’s where you stash and invest money yearly to replace an asset when it’s toast.

Set aside and invest a set amount each year. This fund grows with interest, and by the time the asset’s done, you’ve got the cash to replace it.

It lets businesses save for future asset replacement while earning interest on the savings, ensuring there’s enough dough when needed.

The formula includes the needed lump sum, annual interest rate, compound frequency, and contribution period.

Higher returns from investment, lower risk of surprise expenses, better asset management, and improved cash flow management.

Hard to set asset selling prices, funds diverted from other uses, market volatility risks, complex calculations, and potential profit and loss impact.

Yes, it spreads the asset expense across its useful life, helping with better budgeting and cash flow planning.

It involves detailed calculations and factors like interest rates and compound frequency, making it trickier than other depreciation methods.